My focus has been on product the building, conversing with industry experts, and trying to set up revenue target for the first month after Print Pack – an industry event where we would learn more about the industry and hopefully forge partnerships.

Fundraising is more than a full-time job. Simultaneously, there is nothing much to show for apart from success i.e., getting funded. The outcome is binary.

And herein lies another problem – they do not explicitly say, ‘No’.

That you are not a desirable candidate is understandable, the product idea is not something they would like to invest in – is a totally acceptable answer, and you won’t get them to say it for most part.

You would always get some convoluted response but not a straightforward, ‘No.’ I think it is important to get that denial in full.

My advice here is that we should try to understand why the denial. It will improve the funding process and also open a door for help. It is job of the folks woking at Venture Capitalist firms to find good deals and they often revisit the applicants they have denied earlier, and they also like to be in your good books.

I think I understand TAM i.e., Total Addressable Market – it is basically the sector’s entire revenue opportunity. As a founder and program manager for Machine Dalal, I can feel the market and talking to users has provided more confidence. The caveat however is that the virtual number that I was trying to achieve is higher than what I had imagined it to be.

I shall iterate – The TAM as per my calculations is considerably lower than estimates provided by the experts. This is a good problem to have, only I suck at my job of being the guy in charge of fundraising.

Never do a job that another person can do better than you. Here I am left with two options, bring in an expert, or learn. I am open to both and will focus on both and see how much headway I can make.

The funding woes have begun. For a sound business operation, it is seldom a problem. Building a sound business is however easier said than done.

Earlier in my analysis we were valued less. It is a plain vanilla B2B product which is being magnificently engineered.

In the current scenario my feeling is that our chances have improved.

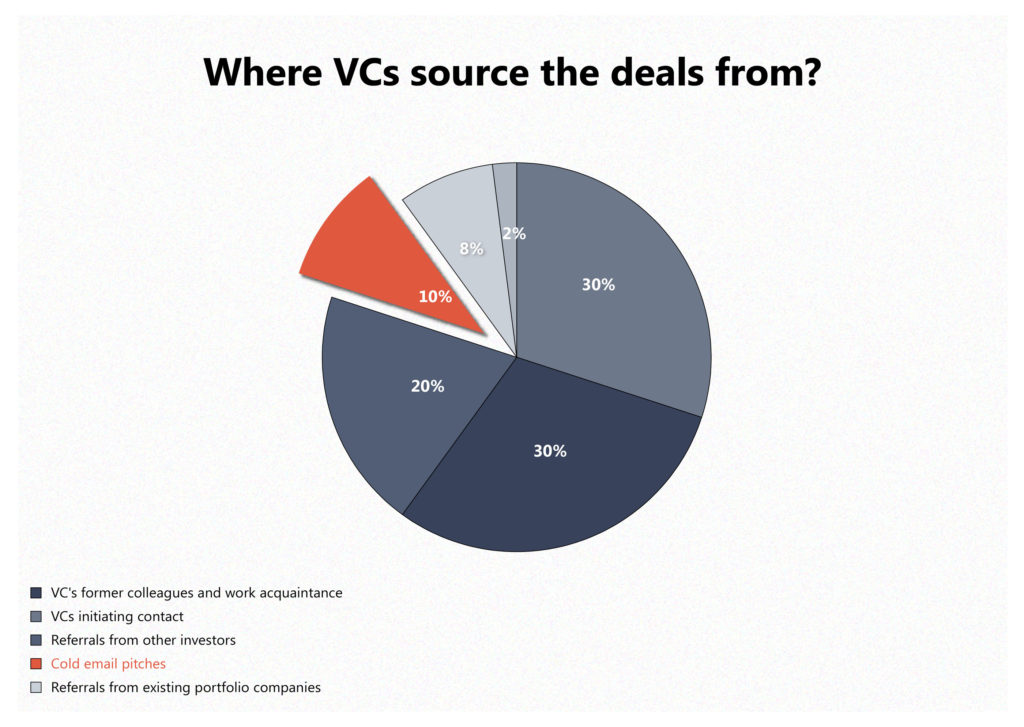

Remember this chart,

I am still at 10% and until next time, when I would have probably taken some steps to improve the odds. I hope you had a good weekend, and may the week ahead be glorious.