This is my first serious attempt at fundraising. Once I started doing the research, I discovered that the odds are not in my favor. I have been in the business of software for a long time and running a profitable enterprise (Hashbrown Systems) for about ten years. But this is a completely new territory for me, hence I have decided to document the whole process and share the findings with the world.

The reason being two-fold, in the worst-case scenario I would learn a lot and it is always good to share what you learn. The second being it should improve my odds of getting this venture funded, as I shall explain below.

Without further ado, let’s jump in.

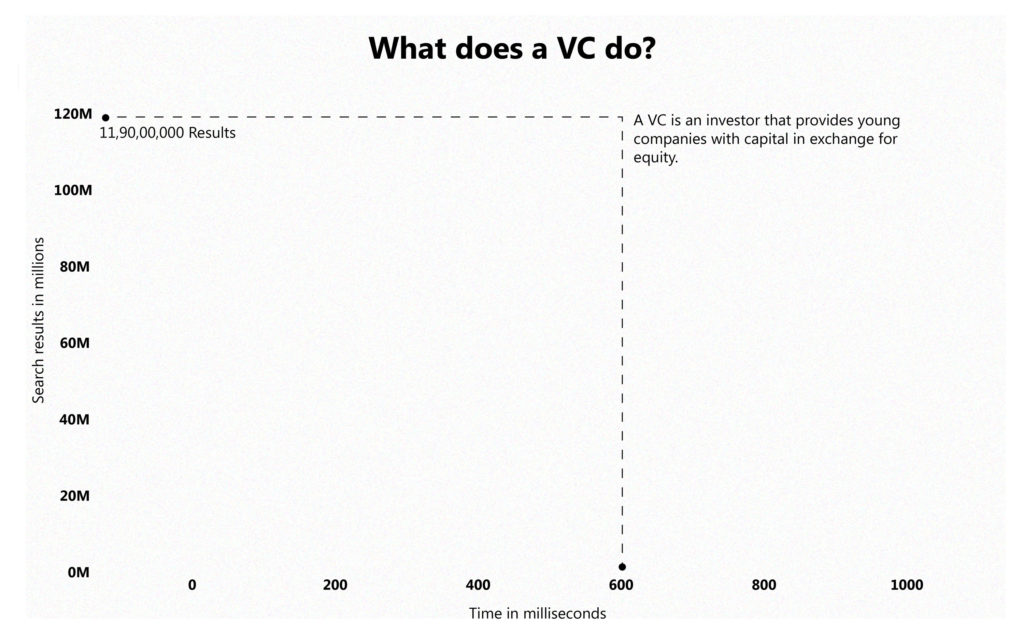

What does a VC do?

As the graph shows, A venture capitalist (VC) is an investor that provides young companies with capital in exchange for equity.

Now that we know what they do. How do they do it?

This is how they do it.

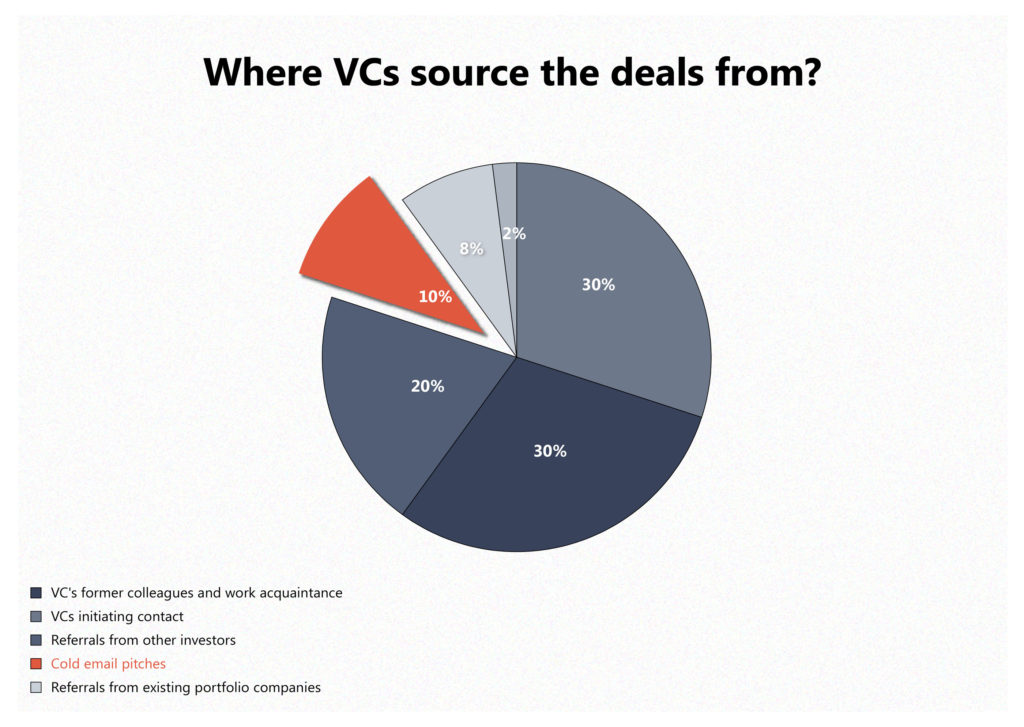

I am in the lowly 10%, my chances of being noticed are mere .1

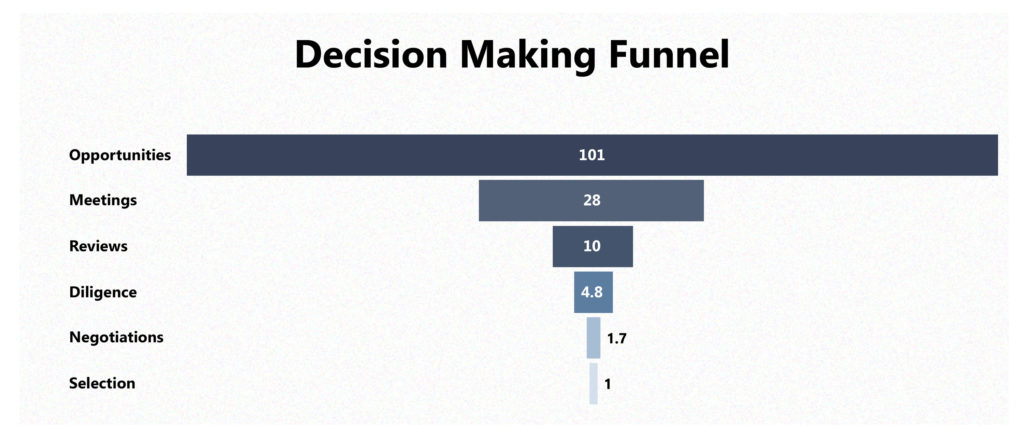

But if you are the one, they have decided on, this is an flow of decision making,

An average deal takes about 83 days to happen.

During which they spend on average about 118 hours to perform due diligence and look for about 10 references.

The odds of Machine Dalal getting funded in the current scenario is .1188 ~ .12. That means out of 1000 applicants 1 gets selected. That is almost 1 tenth of a percent.

These are the odds of Machine Dalal getting selected for venture funding for faster growth.

These are average numbers that I got off from Harvard Business Review research. They are not the absolute truth however, but it gives me something to work for. Also, now this is important, that research does not take into account the quantitative easing that happened during COVID and increased AUM (asset under management) manifold.

The good thing is, the chances of being funded may be higher, the caveat however is that central banks have started to increase rates and that usually does not bode well for venture capital.

However, no one gets rich by betting on sure thing. You profit by buying low and selling high. Machine Dalal comes very close to being a sure thing as we look at the market adoption and growth rate and is priced. quite attractively at the time of writing but that can change quickly or, so I have been told.

Investment Updates

- Y Combinator Summer 2022

- Mosaic Ventures

- Rocket Ventures through Global Founders Capital

- Siddharth via email at Malpani Ventures

This deck will see further improvements, and those shall be duly shared.

Good Night and Good Luck!